Navigating the intricacies of the 2042 C Formulaire can be a complex task. However, with a methodical approach and a sharp understanding of its components, you can conquer this essential form. This comprehensive guide will provide you with detailed instructions to guarantee your success. From filling out the initial sections to tackling more intricate details, we'll walk you through every stage.

- , We'll begin by outlining the fundamental elements of the 2042 C Formulaire. This will provide you with a solid foundation for understanding its structure.

- Following this, let's explore specific sections of the form, offering tips and strategies to accomplish each task effectively.

- , Lastly, we'll address common errors that individuals often encounter and provide solutions to prevent them.

By following this guide, you'll be well-prepared to conquer the 2042 C Formulaire with certainty.

Streamline Your Taxes with 2042 C Pro

2042 C Pro is an innovative software/program/application designed to ease your tax filing experience. With its intuitive interface/design/layout, you can quickly navigate through the complex world of taxes.

The program offers/provides/features a range of tools/functions/capabilities to calculate/determine/figure your tax liability, identify/spot/recognize deductions and credits, and prepare/generate/file your tax return with accuracy/precision/confidence. 2042 C Pro's smart/intelligent/advanced algorithms ensure/guarantee/provide that you maximize/obtain/claim every possible tax benefit/advantage/opportunity.

By utilizing/leveraging/employing 2042 C Pro, you can save/reduce/minimize valuable time/effort/resources and avoid/prevent/mitigate costly errors/mistakes/oversights.

Updates 2042 C Pro 2024: Why You Need to Know

Staying current with the latest developments in technology is vital, especially when it comes to something as impactful as the 2042 C Pro. With 2024 on the horizon, there are a number of exciting updates making waves. Whether you're a seasoned professional or simply curious about the progress of this groundbreaking technology, it's imperative to stay informed.

- This article will delve into the most noteworthy updates for the 2042 C Pro in 2024, providing you with a clear understanding of what's new.

- ,Moreover, we'll explore how these updates impact various aspects of the technology, equipping you with valuable insights.

Get ready to discover the future of the 2042 C Pro as we navigate through the exciting innovations set to shape 2024 and beyond.

An Auto Entrepreneur and the 2042 C Pro

Navigating the complexities of launching a business in France can be challenging. Thankfully, there are Lisez cet article various legal structures designed to simplify this process for aspiring entrepreneurs. Two prominent options frequently considered are the "Auto Entrepreneur" status and registering as a 2042 C Pro company. Selecting between these two paths depends on your unique business model and individual circumstances.

The Auto Entrepreneur regime is known for its simplicity and flexibility, making it an attractive choice for solopreneurs and small businesses with minimal overhead. It offers a streamlined process for registration and tax filing, along with a relatively low initial investment. However, it also comes with certain limitations regarding revenue thresholds and allowable business activities.

Alternatively, registering as a 2042 C Pro company provides more freedom. It offers greater flexibility in terms of business operations and allows for the formation of partnerships. While this structure demands a more rigorous setup process and potentially higher initial costs, it unlocks access to wider financial resources and opportunities.

Finally, determining the best legal structure for your business demands careful consideration of your goals, scale of operations, and financial standing. Consulting with a qualified legal or financial advisor can provide valuable insights and guidance in navigating this crucial decision.

Comprehending the 2042 C Formulaire for Individuals

Navigating the complexities of tax forms can often be a daunting task. The 2042 C Formulaire, specifically designed for taxpayers, presents its own set of obligations. To effectively complete this form, a in-depth understanding of its format is crucial.

- First and foremost, it's essential to identify your eligibility for filing Form 2042C. This form is typically used by residents in France who have income from various origins.

- Next, familiarizing yourself with the various chapters of the form is vital. Each section addresses specific aspects of your financial information.

- Finally, it's highly advised to consult with a tax advisor if you encounter any complexities while completing the form. Their guidance can be invaluable in ensuring an accurate and timely filing.

Optimizing Your Business Taxes in 2042

In the ever-evolving landscape of business operations, staying ahead of the curve is paramount. As the complexities of current tax regulations, businesses must robust solutions to ensure seamless adherence. The 2042 C Pro platform emerges as a game-changer, providing cutting-edge technology to streamline your tax processes and reduce time and resources.

- Leveraging AI-powered algorithms, 2042 C Pro accurately analyzes your financial data to identify potential savings.

- It automates complex tax filings, minimizing the risk of errors.

- Moreover, 2042 C Pro offers real-time insights into your tax liability, empowering you to make strategic decisions.

Navigating the 2042 C Pro Returns Filing Process

Preparing and submitting your Fiscal year 2042 C Pro returns can seem like a daunting task. However, with the right guidance and methodologies, you can simplify this process. This comprehensive guide will provide you with the crucial information and steps to seamlessly navigate the 2042 C Pro filing platform. From grasping the requirements to leveraging your deductions, we'll cover everything you need to know. Whether you are a seasoned filer or new to this process, our useful tips will empower you to assuredly complete your 2042 C Pro returns with fidelity.

Financial Optimization Strategies with 2042 C Pro 2024

Leveraging the robust features of 2042 C Pro 2024 empowers individuals to execute sophisticated tax planning strategies. This comprehensive software provides advanced forecasting capabilities, enabling users to minimize their tax liability. With its intuitive interface, 2042 C Pro 2024 simplifies the tax planning process, assisting users to make strategic decisions. By utilizing its features, entities can strategically manage their fiscal obligations and obtain significant tax reductions.

9. 2042 C Pro vs. Formulaire: Selecting the Right Option

When it comes to selecting the perfect tool for your needs, the decision can often feel overwhelming. This is especially true when faced with two strong contenders like the 2042 C Pro and Formulaire. Both offer a wealth of features and functionalities, but they cater to unique user profiles and use cases. To help you navigate this important choice, let's delve into a comparative analysis of these two tools. First, consider your main requirements. Are you looking for a solution that prioritizes speed and output? Or is it user-friendliness and ease of use that matter most? Understanding your priorities will guide you towards the ideal fit.

Next, let's explore the capabilities of each option. The 2042 C Pro is renowned for its powerful functionalities and ability to handle intricate tasks with ease. On the other hand, Formulaire stands out for its intuitive interface and user-friendly design, making it a perfect choice for newcomers.

Finally, don't forget to factor in your budget and any individual requirements you may have. By carefully considering these factors and conducting thorough research, you can confidently arrive at the right choice for your specific needs.

Navigating Income and Expense Declarations with 2042 C

Successfully completing income and expense declarations for your 2042C filing can seem like a daunting endeavor. But with the correct understanding of guidelines, you can securely oversee this process. First, gather all your financial records. This includes earnings statements, expense bills, and any applicable tax forms. Once you have compiled your information, precisely review the 2042C manual provided by your tax board. Pay close heed to the specific regulations for each subsection.

- Additionally, be sure to verify all your figures for accuracy. Any errors can result delays or problems. {Finally|, Keep a copy of all your declarations for your own archives.

Filing 11 Common Errors to Bypass When Filing Form 2042 C

When completing your Form 2042C, prevent these common mistakes. A incorrect filing can cause delays and fines. First, double-check you have the current version of the form. Next, carefully examine all guidelines before you commence filling it out. Commonly, filers miss important data. Pay close attention to timeframes and amounts. Confirm all numbers for precision.

- Proofread your form thoroughly before filing it.

- Employ black or blue ink only.

- Initial the form as indicated.

Failure to observe these tips can cause issues.

Optimize 2042 C Pro Auto Entrepreneur: Simplified Tax Reporting

For entrepreneurs selecting the 2042 C Pro Auto Entrepreneur regime in France, tax reporting has been markedly simplified. The new system aims to minimize the administrative burden, facilitating businesses to devote their resources on development. This change implements a more intelligible and optimized process for tax filings, finally saving entrepreneurs valuable time and effort.

Utilizing the provisions of Form 2042C can significantly impact your tax burden. Here are some key strategies to optimize your tax savings:

* First, ensure you accurately report all income and expenses related to your business.

Maintain meticulous records throughout the year to facilitate this process.

* Investigate eligible deductions and credits that pertain to your specific sector. This could include deductions for promotion expenses, travel, and innovation.

* Collaborate with a qualified tax expert who has in-depth knowledge of Form 2042C. They can deliver personalized guidance and strategies tailored to your unique position.

* Stay informed about any recent updates in tax laws and regulations that may impact Form 2042C filing requirements.

The Latest Changes to 2042 C Pro in 2024

2042 C Pro has undergone a number of transformative updates in 2024, bringing innovative functionalities to the platform. Highlighting these changes are significant improvements to its essential features, leading to a more efficient user experience. Additionally, the 2024 update introduces advanced technologies that streamline performance.

- Additionally, the 2024 update solves previously reported issues, providing a more reliable platform.

Grasping the Various Sections of 2042 C Formulaire

Navigating the intricacies of the 2042 C Formulaire can be complex, particularly when encountering its diverse sections. Each section plays a crucial role in providing comprehensive information required for accurate tax filing.

For instance, Section A typically encompasses personal information, while Section B focuses on income. Furthermore, Sections C and D often delve into expenses and other relevant considerations. To ensure a smooth and successful tax filing experience, it is essential to carefully review and understand each section's role.

Exploiting Online Resources for 2042 C

To excel in the dynamic landscape of 2042 C, it's crucial to effectively access the wealth of online resources available. These platforms offer a buffet of information, tools, and communities that can significantly augment your understanding. Begin by discovering the specific resources aligned to your goals. Leverage search engines, online libraries, and specialized forums to uncover valuable content. Engage actively in online communities to collaborate knowledge with peers and professionals. Remember, the online world is a constantly evolving space, so remain current of new developments and trends.

Tackling 17. Free Tools and Templates for Filing Your 2042 C Taxes

Filing your annual returns can be a daunting challenge, especially when dealing with complex documents like Form 2042C. Luckily, there are plenty of free tools and templates available to simplify the process and ensure accuracy. Whether you're searching for guidance on filling out specific sections or require a complete structure, these resources can be invaluable.

Discover these platforms to streamline your 2042C filing experience and reduce time and effort.

Seeking Professional Assistance with Your 2042 C Pro Return

Tax returns can be complex, especially when dealing with complicated forms like the 2042 C Pro. If you're finding yourself struggling with your return, consider seeking professional assistance from a qualified tax preparer.

A tax expert can assist you through the process,ensuring that your return is precise and that you maximize all available benefits.

They can also offer valuable suggestions on financial strategies to minimize your tax liability in the future.

Remember, allocating in professional help can generate you time and money in the long run.

Common Queries About 2042 C Formulaire and Pro

Are you seeking answers to common questions about 2042 C Formulaire and Pro? You've come to the right place! This section provides clear and concise answers to frequently asked questions. Whether you're a new user or an experienced seasoned user, our FAQs will help you learn more about this powerful software.

- What can 2042 C Formulaire and Pro perform?

- Where can I access 2042 C Formulaire and Pro?

- Describe the system specifications for 2042 C Formulaire and Pro?

Don't hesitate to browse our comprehensive list of FAQs. If you can't find the solutions you need, please don't fail to contact our helpdesk. We're always here to aid you.

Maintain Compliant: A Guide to 2042 C Tax Filings for All

As we navigate towards the year 2042, it's crucial for all taxpayers to understand themselves with the latest tax regulations. Specifically, C corporation submissions are set to undergo noteworthy changes. This guide aims to provide a in-depth overview of the new 2042 C tax filing obligations, ensuring that you stay compliant with the evolving tax environment.

- Familiarize about the essential changes to C corporation tax documents for 2042.

- Uncover the impact these updates will have on your taxable income.

- Develop valuable insights to optimize your 2042 C tax filing process.

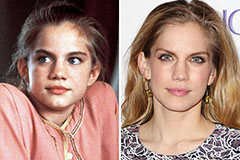

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Alisan Porter Then & Now!

Alisan Porter Then & Now! Mike Vitar Then & Now!

Mike Vitar Then & Now! Kane Then & Now!

Kane Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!